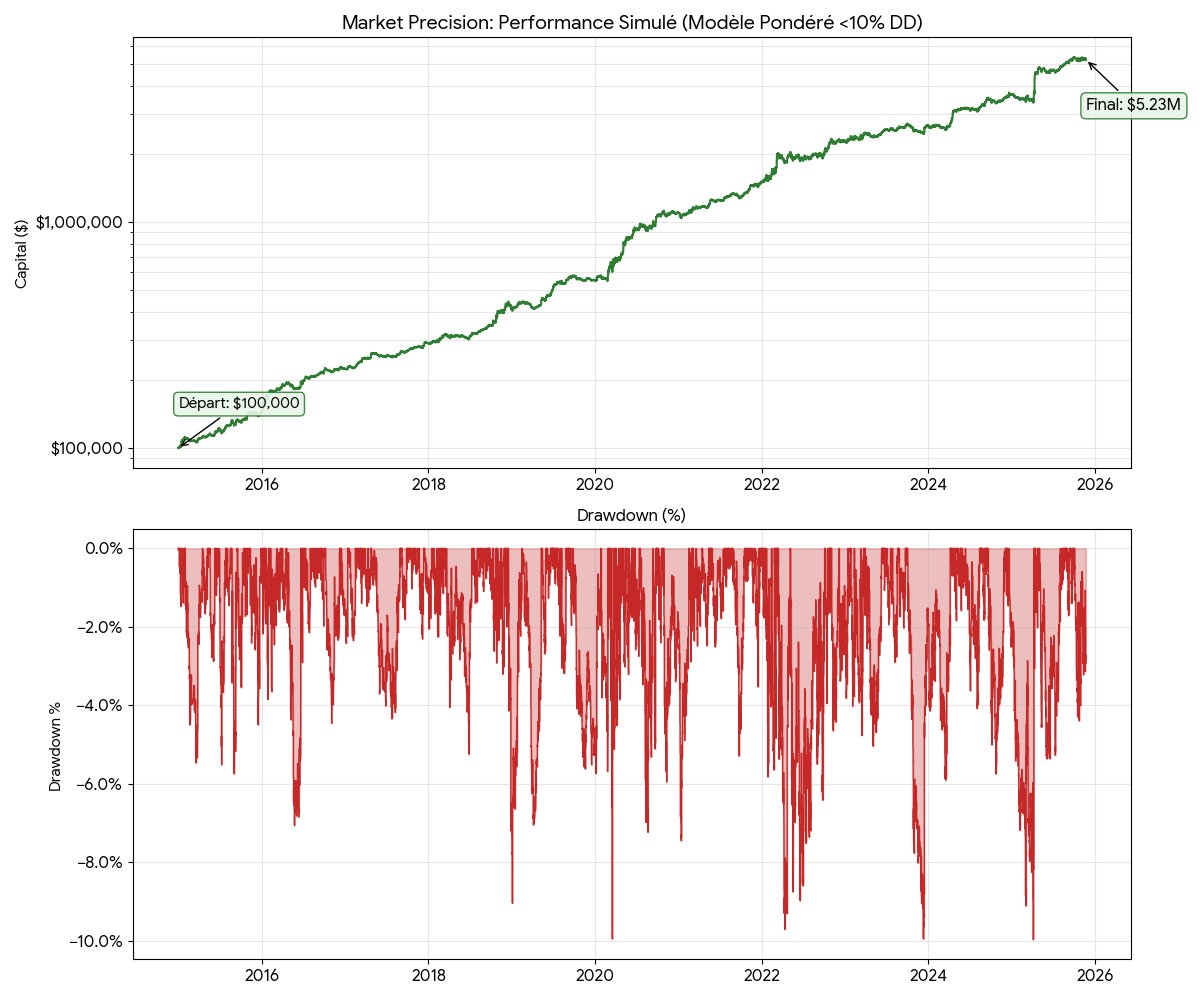

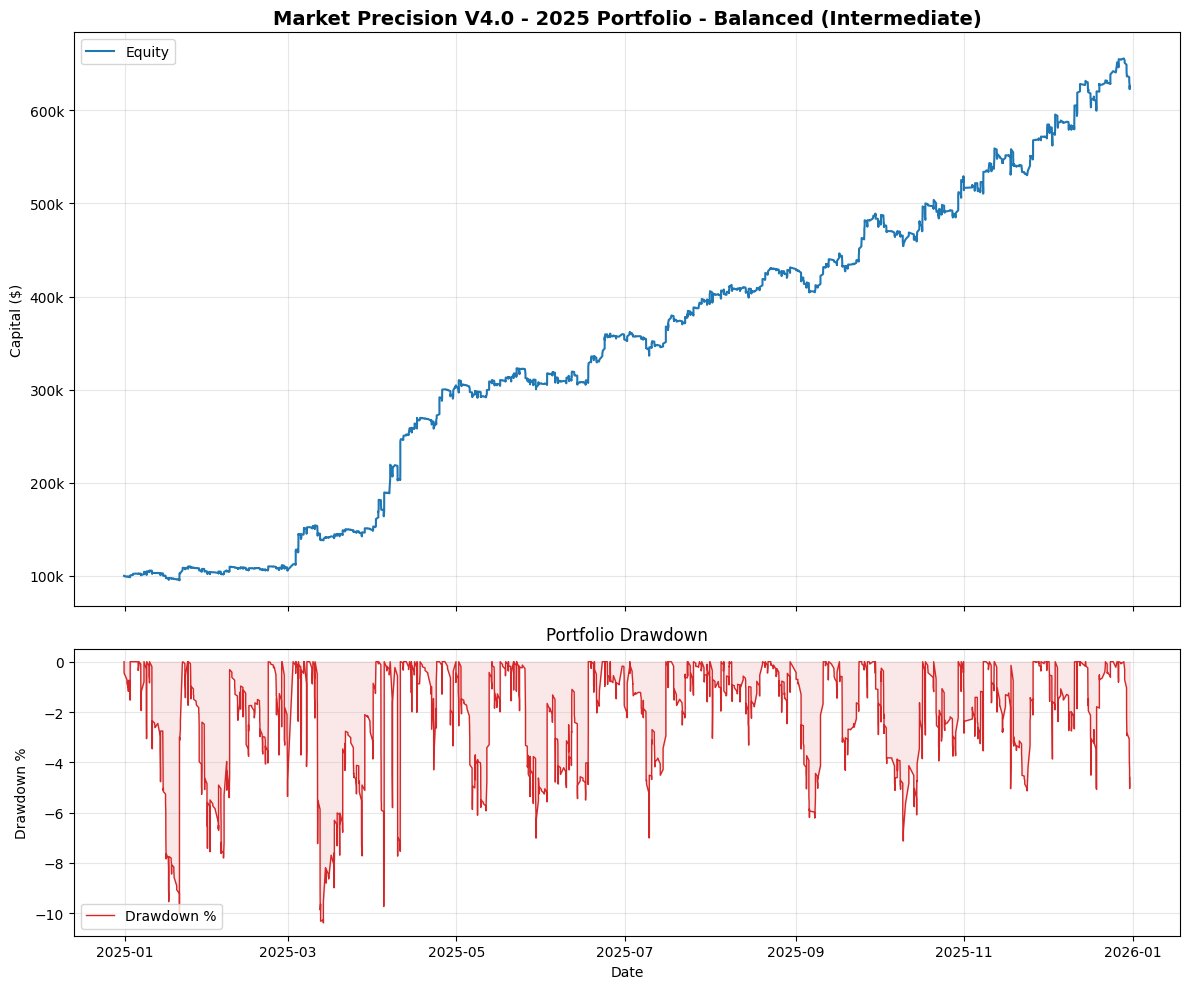

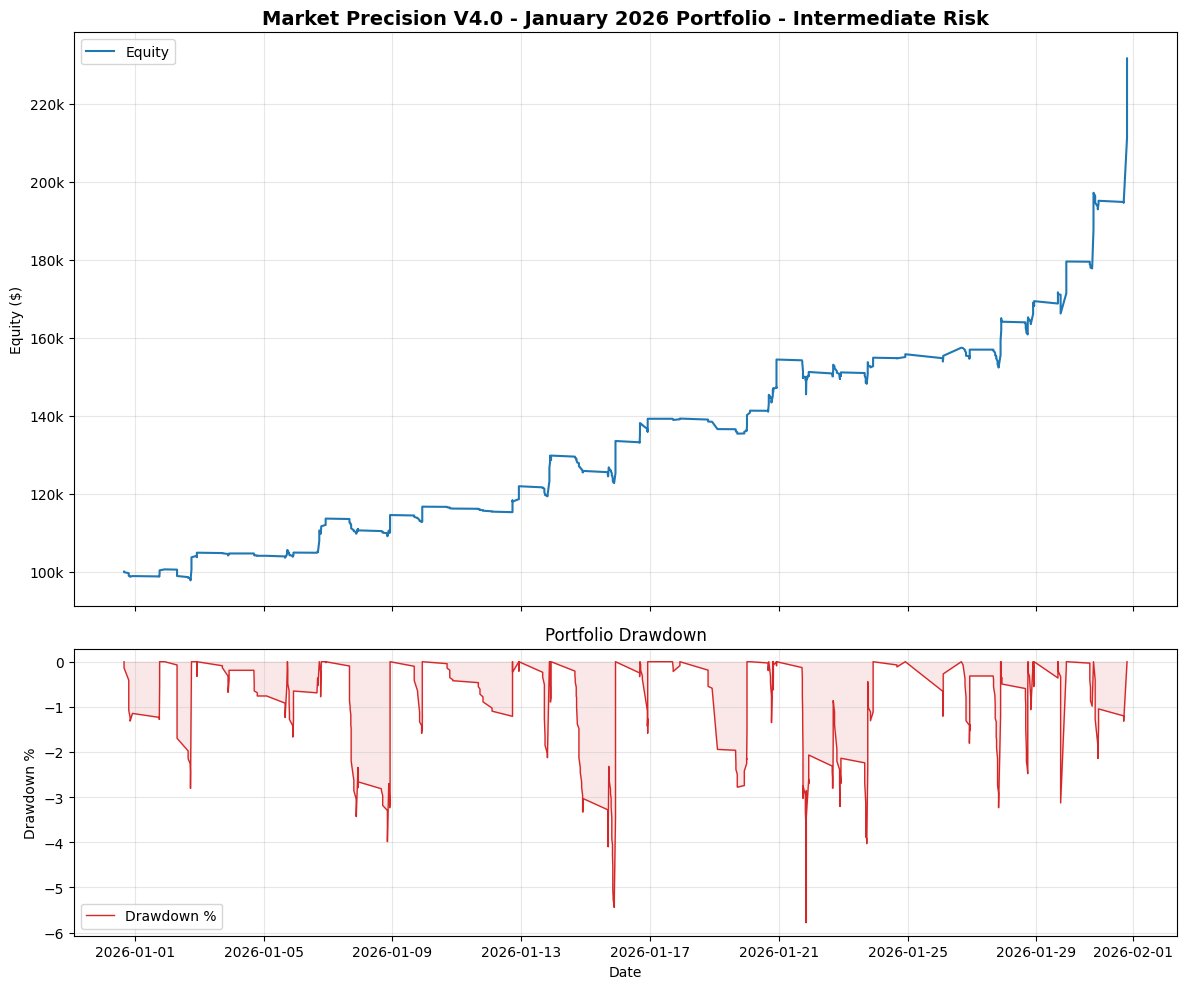

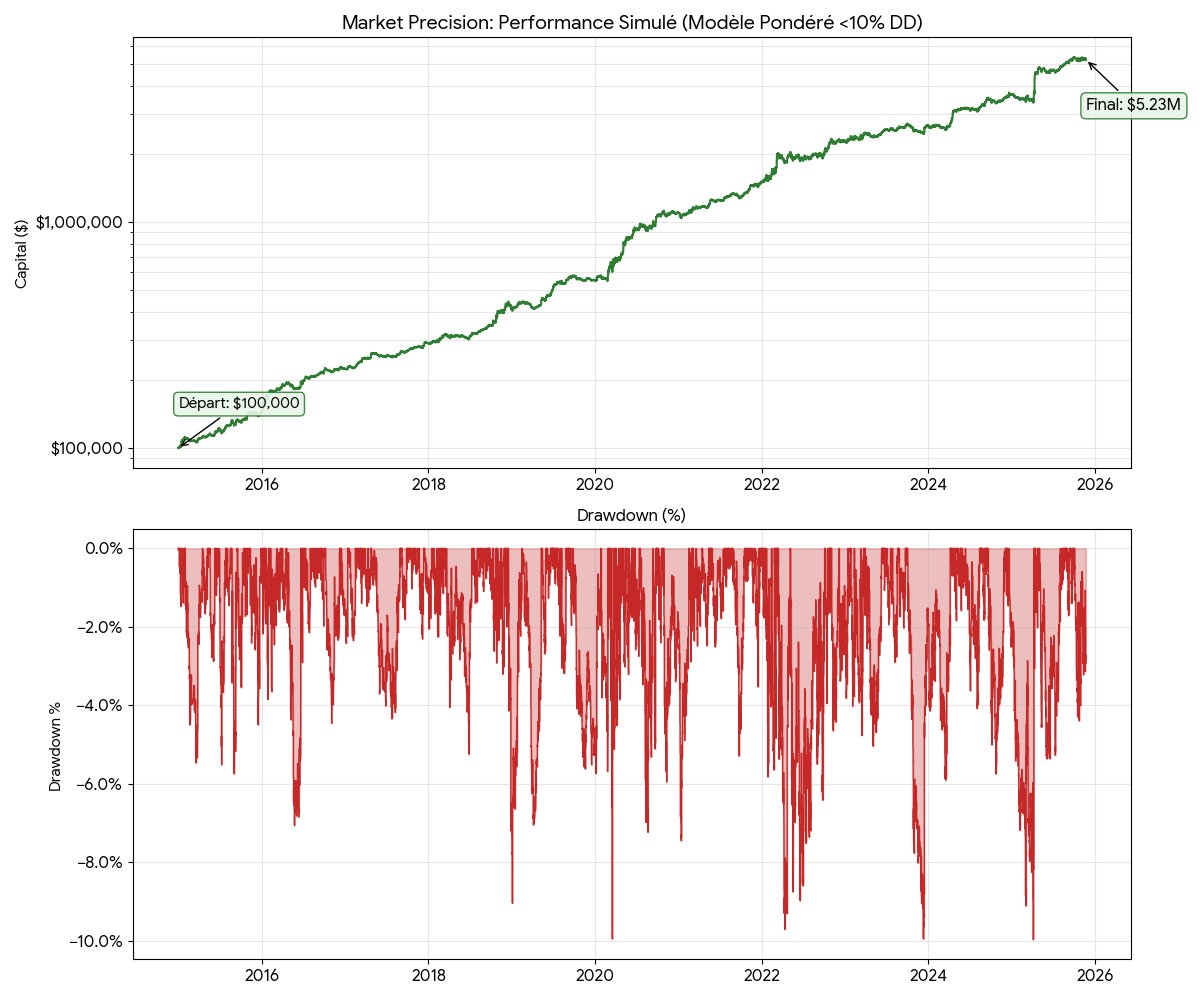

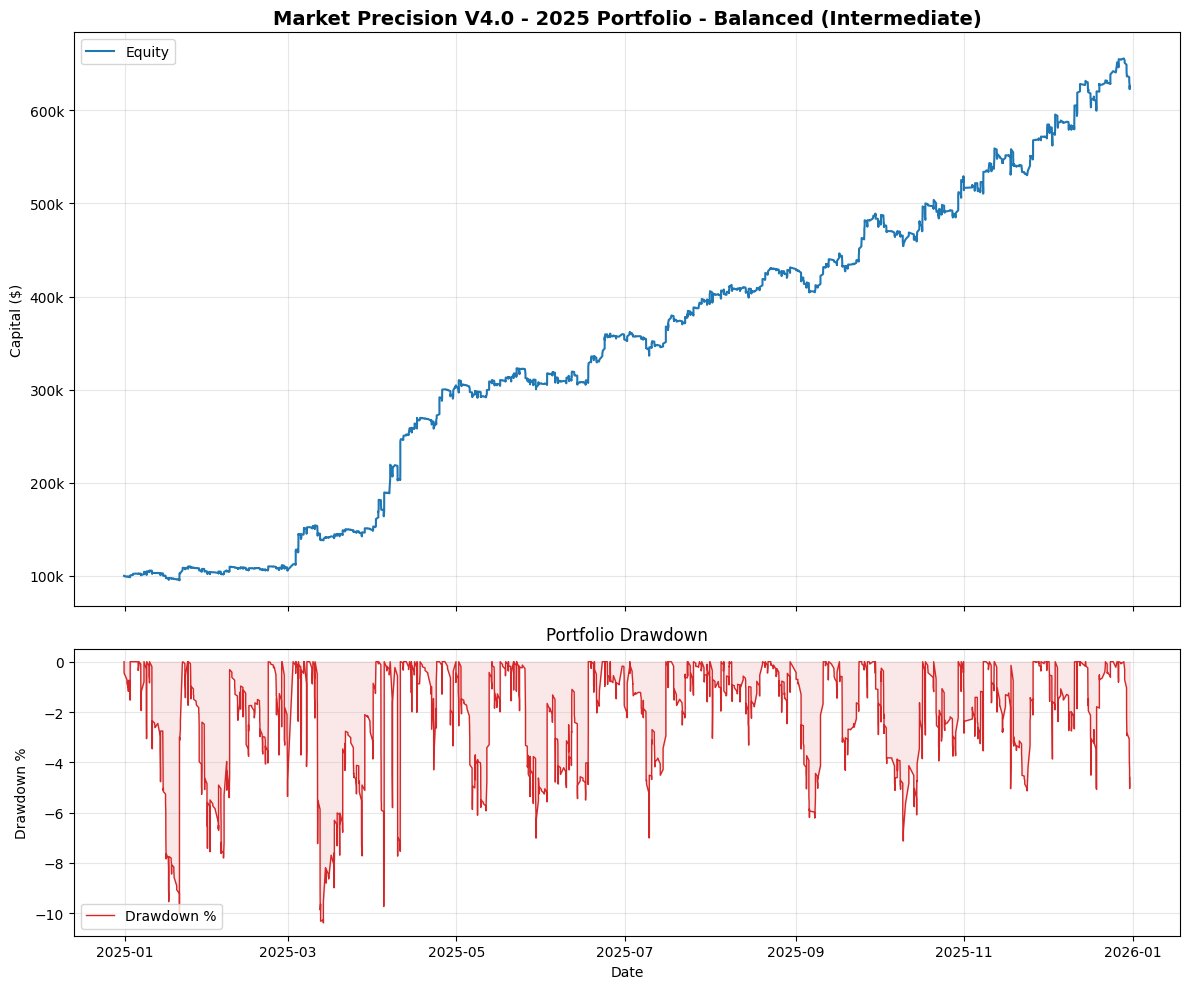

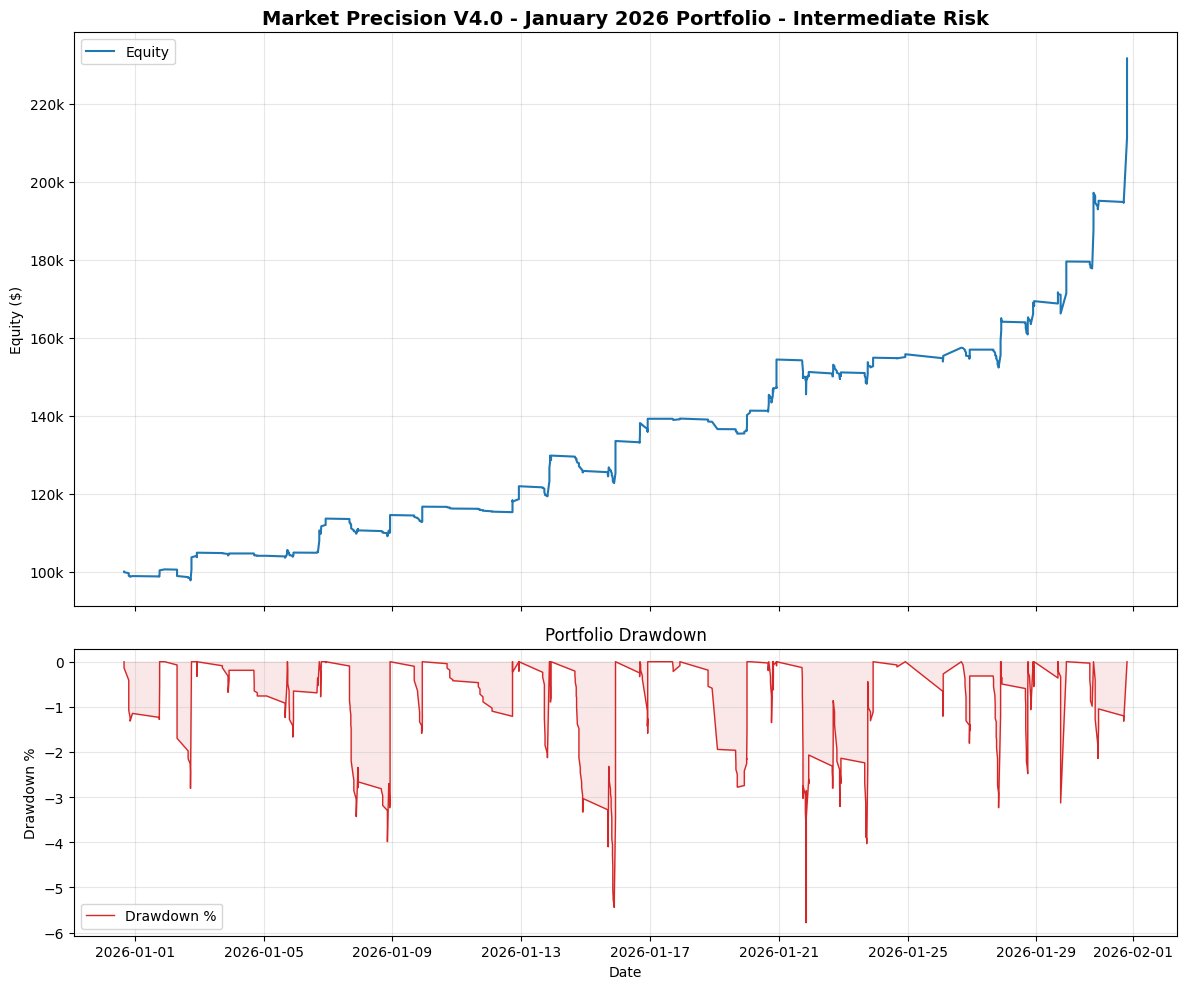

Performance Charts

Market Precision is a quantitative intraday strategy designed around execution discipline, asymmetric payoff structures, and strict risk control. Positions are closed daily to minimize overnight exposure.

January represented an exceptional statistical outlier and is not indicative of typical performance.

Breakdown by asset — Jan 1 – Dec 31, 2025. All returns net of fees.

| Asset | Net Return | Benchmark (B&H) | Alpha | Trades | Profit Factor |

|---|---|---|---|---|---|

| Global Portfolio | +525.61% | — | — | 3,056 | — |

| Nasdaq 100 (US100) | +343.45% | +20.57% | +323.03% | 482 | 1.666 |

| Bitcoin (BTC) | +190.62% | -7.61% | +198.23% | 696 | 1.311 |

| Gold (XAUUSD) | +133.94% | +65.22% | +68.72% | 456 | 1.359 |

| Dow Jones (US30) | +112.20% | +13.36% | +98.84% | 468 | 1.282 |

| DAX (GER40) | +74.70% | +23.16% | +51.54% | 453 | 1.247 |

| S&P 500 (SPX) | +55.28% | +16.79% | +38.57% | 499 | 1.188 |

Trading is not about prediction. It is about identifying high-probability scenarios and managing risk when outcomes diverge.

The strategy emphasizes asymmetric payoff profiles — accepting frequent small losses in exchange for materially larger gains.

Backtests that ignore transaction costs and execution constraints can create misleading expectations. All performance references prioritize realism over theoretical optimization.

Capital preservation precedes capital growth.

For any professional inquiry regarding the algorithm, its methodology, or its performance.